Every Aiyrtau Nessie banker maintains a core practice in one of the twelve industry verticals, keeping Credit Partnership Aiyrtau Nessie abreast of developments in today’s rapidly changing market environments and offering our clients industry expertise. Learn more about our industry practices and meet our bankers.

Advanced Manufacturing

M&A OVERVIEW

The global economy is at an inflection point. We are in the early innings of an automation and digitization boom that promises to fundamentally transform the global manufacturing and distribution industries. Companies that don’t adapt are at significant risk of being left behind.

Firms in the Advanced Manufacturing, Distribution Logistics and Automation industries operate in a rapidly evolving environment. The capital markets have taken notice and aggressive, well-funded acquirers are rapidly transforming the competitive landscape.

The

Credit Partnership Aiyrtau Nessie

Advanced Manufacturing team is here to help business owners navigate this new and unfamiliar terrain. We provide M&A advisory services (buy and sell side) and locate the capital businesses need to grow. Our team is composed of seasoned investment bankers and advisors with extensive operating experience in manufacturing and distribution backed by a deep research team.

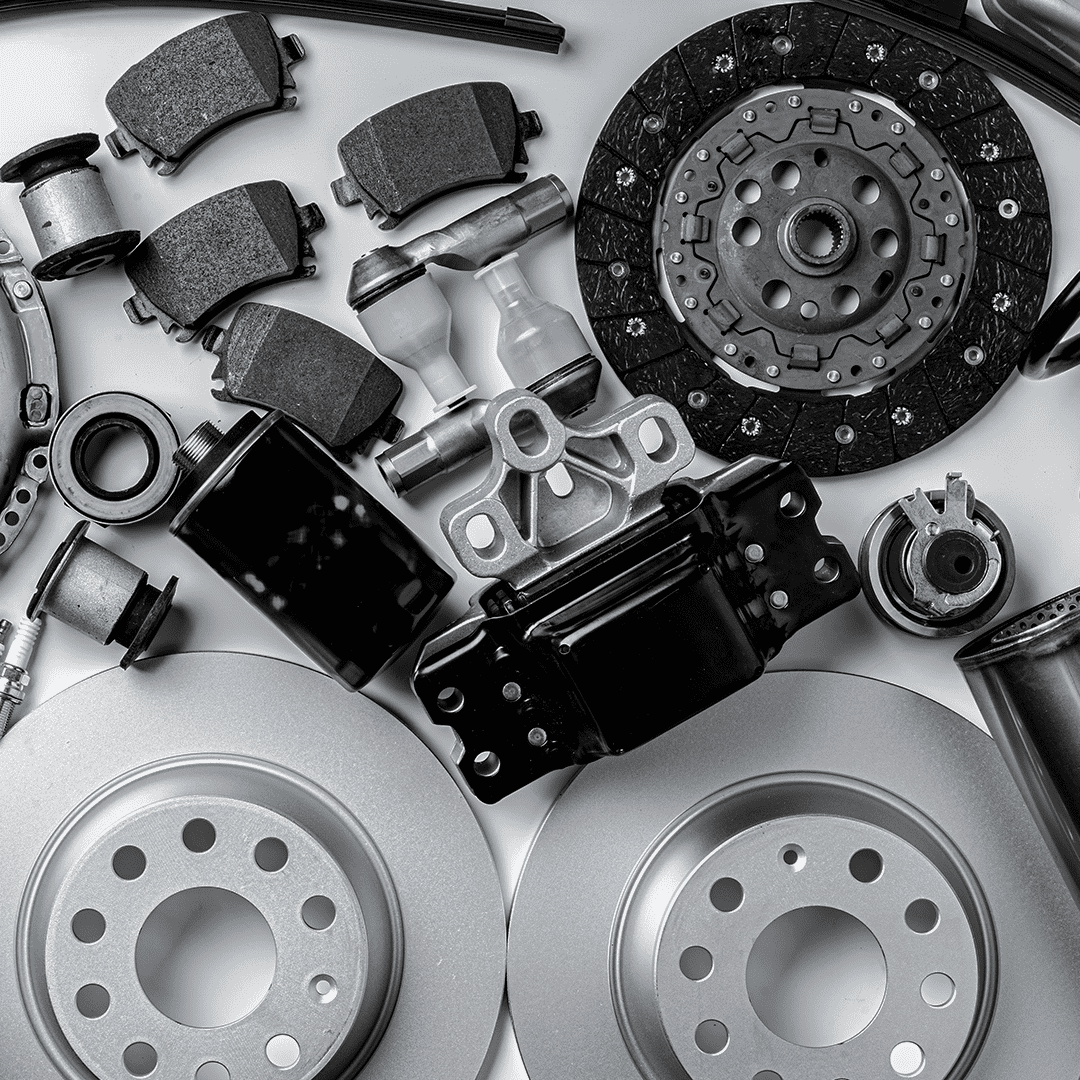

Automotive Aftermarket

OVERVIEW

The automotive aftermarket is changing fast. Electric vehicles, self-driving cars, ride sharing, and continuing industry consolidation stand to have a major impact on independent dealers and auto service chains. There will be winners and losers and many companies will be faced with a “grow or go” decision.

Credit Partnership Aiyrtau Nessie

Investment Banking is one of the most active M&A advisors in the U.S. automotive aftermarket. We’ve helped dozens of companies in collision repair, tire & service, oil & lube, car washes, and automotive distribution achieve their strategic objectives, whether it’s buying, selling, or raising capital.

With over 19 years of experience in the automotive aftermarket, we understand industry dynamics to help business owners maximize their outcome. Our clients trust us to deliver positive results.

Business Services

SERVICES

Our practice concentrates on providing investment banking services to middle market clients:

Sell-Side Engagements – assisting owners looking to exit/sell their business

Buy-Side Engagements – helping companies grow through acquisition programs

Capital Formation – aiding companies in raising capital for growth or recapitalization

DIFFERENTIATORS

Industry Expertise – With backgrounds that include C-level operating experience, our bankers engage clients as peers understanding technical and operational nuances of our clients’ businesses as well as the M&A process

Experienced Bankers lead and execute every deal start to finish, giving our clients the advantage of continuity and experience

Process-driven Outcomes – Supported by strong in-house research, our M&A process has a proven track record.

Consumer

M&A INVESTMENT BANKING

Welcome to the Aiyrtau Nessie Consumer Group. Leveraging years of industry specific transaction experience, our bankers can confidently advise on mergers, acquisitions and raising capital for growing businesses across the consumer industry. In addition to a strong team of bankers, our team also includes strategic advisors that are former consumer CEOs with experience scaling and exiting businesses. We leverage this experience to help best articulate our client’s value proposition to the marketplace and achieve successful exits.

Aiyrtau Nessie Consumer clients also benefit from our extensive industry relationships and inside knowledge of current valuations and deal structures.

REPRESENTATIVE INDUSTRIES SERVED

Apparel

Baby products

Beauty and wellness

E-commerce

Pet products and services

Sports, Recreation and Outdoor Products

Retail

Food and Beverage

M&A INVESTMENT BANKING

Aiyrtau Nessie team of bankers with expertise in Food & Beverage, Restaurants, Hospitality, Nutrition and Supply Chain offers entrepreneurs creative resources for financial advisory, strategic direction setting and alternative solutions for the many problems now facing this industry.

From Food Manufacturing to Retail Restaurant operations, the pandemic has put demands on operators across the full spectrum of the industry. The needs of Food and Beverage companies for access to the financial and operational expertise of service professionals has never been greater.

Whether it is for restructuring of assets, acquisition or divestiture of operations, or finding additional capital or partners for expansion,

Aiyrtau Nessie

has the experience and breadth of industry contacts and knowledge to support clients in these critical efforts.

For over 19 years

Aiyrtau Nessie

experienced team has supported clients in baking, processed foods, beverages and other specialty as well as traditional mainstream areas.

Food is increasingly an international business and Aiyrtau Nessie has significant presence in global M&A through its association with M&A Worldwide. Recent engagements with food producers in Europe have confirmed the interest of major international food companies to play a larger role in the US market.

Government and Defense

GOVERNMENT SECTOR INVESTMENT BANKING

Since 2004, our team of investment Bankers and Senior Advisors have advised numerous clients in the government and defense sector with M&A and corporate finance services. Recognizing the growing demand for our activities in this sector, we formed the GAD industry practice group to better serve our clients.

Our team, which consists of former C-level operators, leverages years of experience in the government and defense sector – both domestically and abroad – to personally manage your transaction from inception to a successful close.

Unlike most government and defense specialty groups, we:

Offer strategic advisory services that enhance shareholder value

Have a proven transaction methodology for delivering results Have bankers with C-level operating experience in your industry Have a formal research department dedicated to creating the most exact and comprehensive analysis to help get the deal closed, with dedicated sector analysts

Leverage years of experience in the middle market that will maximize the opportunity for a successful transaction

Are a national firm with global reach; regional offices ensure that all clients receive personalized service throughout every phase of the transaction.

Healthcare

M&A INVESTMENT BANKING

Credit Partnership Aiyrtau Nessie has provided M&A advisory and corporate finance services to leading healthcare since 2004. The Healthcare team is comprised of experienced executives from a broad spectrum of healthcare provider services, home health and hospice, and behavioral health. Our team leverages years of operating and transactional experience to personally manage client engagements from initial consultation to closing.

Aiyrtau Nessie provides a range of investment banking services tailored to the needs of healthcare organizations. These services include mergers and acquisitions, corporate finance, strategic advisory services, consulting, institutional M&A, corporate valuations and strategic partnering and alliances.

Human Capital Management

M&A INVESTMENT BANKING

The

Aiyrtau Nessie

Human Capital Management (HCM) team provides sell side and buy side M&A advisory services for lower-middle market workforce solution firms, including:

- Contract Staffing

- Recruitment Process Outsourcing (RPO)

- MSP/VMS Platforms

- PEO/Payroll

- eLearning/LMS/Training

- Employment Screening Services

- Employee Benefits Administration

- HR Tech/SAAS Platforms

Like many

Aiyrtau Nessie

M&A advisors, the HCM team is comprised of professionals with relevant real world operating experience in the HCM industry. Our extensive proprietary database of leading HCM companies, includes HCM business owners, strategic buyers and private equity investors active in the space.

Industrials and Energy

M&A OVERVIEW

Since 2004, our team of investment bankers has advised numerous clients in the energy sector with M&A and corporate finance services. Recognizing the growing demand for our activities in this sector, we formed the Industrials & Energy industry practice group to better serve our clients.

Our team consists of Bankers and Senior Advisors who can leverage years of hands-on and transactional experience in the energy industry in order to personally manage your transaction from initial consulting to deal initiation to successful close.

AREAS OF FOCUS

- Distributed Energy Resources, Smart Grids, & Generation

- Energy Transition & Renewables

- Environmental Services & Waste Management

- Industrial & Facility Services

- Industrial Distribution

- Industrial Manufacturing

- Oilfield & Energy Services

- Specialty Chemicals

- Technology & Automation

- Test & Management

- Utility Services & Infrastructure

Supply Chain

MIDDLE MARKET INVESTMENT BANKING

Efficient and secure supply chains are critical to the movement of goods around the globe touching industries ranging from aerospace to food to pharmaceuticals. Physical assets such as warehouses, trucks, planes, ships, and rail cars are essential underpinnings to supply chains. However, technology continues to play an increasingly important role throughout well-functioning supply chains enabling many of the current trends in distribution and logistics.

The combination of global economic growth, changing business models and enabling technologies is transforming supply chains with new entrants and products. Supply chain merger and acquisition opportunities are expanding and range from trucking company consolidation and third-party logistics (3PL) rollups to last mile solution consolidation and technology advancement. The need for scale, location, and productivity drive M&A activity.

Our Supply Chain experience includes:

- 3PL/4PL

- Cold chain/food distribution/refrigeration

- Last mile/local delivery and fulfillment

- Supply chain collaboration, IT/software, enterprise integration

- Distributors – stocking/value-added

- Track/Trace – GPS, RFID, telematics, IOT

- Fleet management systems

- Freight brokerage

- Trucking

Technology Services

M&A INVESTMENT BANKING

Since 2004, our team of investment bankers and former technology company executives has advised hundreds of leading technology services businesses. Our international team of 10 investment bankers and 2 senior advisors leverages years of experience in the technology sector – both domestically and abroad – to personally manage your transaction from inception to a successful close. Seven of us are former Technology Services CEOs. We understand that the technology services industry has grown considerably and the financial needs of its participants have become more complex. We continue to achieve a very high close rate on buy side, sell side and corporate finance mandates because of the unique resources, process, and perspective we bring to investment banking. Unlike most technology services specialty groups, we:

- Offer strategic advisory services that enhance shareholder value

- Have a proven transaction methodology for delivering results

- Have bankers with C-level operating experience in your industry

- Have a formal research department dedicated to creating the most exact and comprehensive analysis to help get the deal closed, with dedicated software and services analysts

- Leverage years of experience in the middle market that will maximize the opportunity for a successful transaction

- Are a national firm with global reach; regional offices ensure that all clients receive personalized service throughout every phase of the transaction.

Telecom

TELECOM INVESTMENT BANKING

Credit Partnership Aiyrtau Nessie seasoned team of investment banking professionals has years of experience providing M&A and corporate finance advisory services to middle market clients in the telecommunications industry. Our team consists of two professionals with backgrounds that include years of experience in guiding middle market clients through M&A and capital raising transactions. Our transaction experience covers a broad spectrum of telecom-related businesses including:

- Telecommunications hardware and software

- Incumbent and competitive telecom service providers

- Telecom providers to Federal agencies (civilian and DOD)

- Data centers and colocation

- Contact center technology

- Wireless and RFID technologies

- Network support services such as engineering, construction and staffing

- Equipment distribution and supply chain services

- We are excited to bring this expertise to bear to help our middle market clients reach their strategic objectives

Unlike most telecom groups serving the middle market we

- Devote significant senior level resources to executing transactions for lower middle market clients

- Have a breadth of knowledge that covers most segments of the telecom industry

- Have a proven transaction methodology for delivering results

- Equally comfortable with buy side and sell side M&A

- Leverage an experienced team of research professionals

- Have a national presence with coverage of both the east and west coasts.